By 2050, 89% of the US population will live in urban areas.1 But are we going to be able to afford big city living?

America’s Most Expensive Cities per Square Foot

For over 8 years Move.org experts have examined pricing, credentials, and real customer reviews to give you (human) recommendations you can trust. See how we review.

Although the most expensive cities may be the most desirable for some, the growing economic inequality in America makes the cost of renting or buying in those cities beyond the budget of many current or potential residents.2

Nearly a third of Americans say it’s been hard to make rent or mortgage payments since roughly six months ago when the coronavirus outbreak hit the economy.3 Even before then, many folks were looking to either move to a cheaper area or downsize with a storage unit’s help.

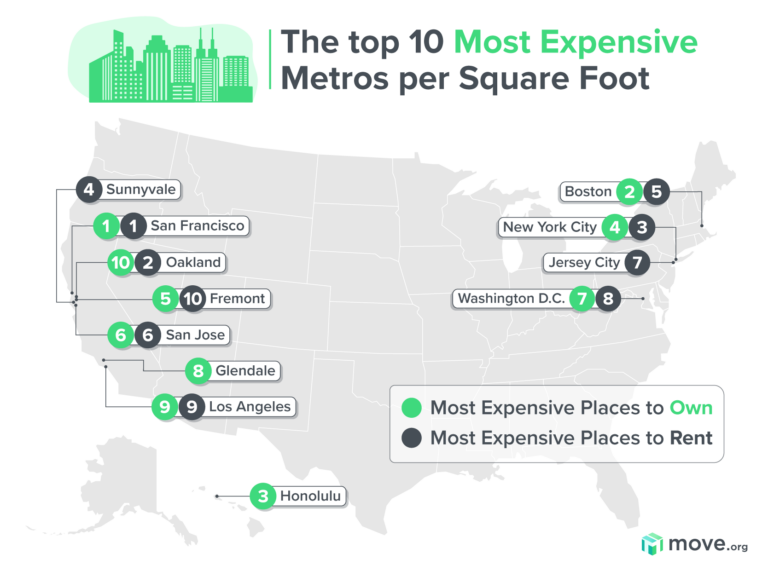

Using the 200 most populous cities in the US, we made lists of the top ten cities with the highest price per square foot for both renting and owning.

The Top 10 Most Expensive Cities in America

- San Francisco, CA

- Boston, MA

- New York City, NY

- Fremont, CA

- San Jose, CA

- Washington DC

- Los Angeles, CA

- Oakland, CA

California continues to be the costliest place for renters and owners alike, with wage inequality and rising housing costs5 making it difficult to afford. Currently, more than a third of Californians live in or near poverty.6

The contrast of California’s poor and rich residents involves many different factors, but ultimately, the Golden State is one of the most expensive places to live in America.

Buying may be a better option in some areas, while renting is the less expensive choice in others. Which cities are the most expensive for homes regardless if you’re buying or renting?

Other than California’s cities, Boston, New York City, and Washington DC are the most expensive places to live whether you’re buying or renting.

Check out our Best Moving Companies of 2024 guide that our moving experts put together after researching professional moving companies across the country to determine the ones that can make your long-distance move the most organized, easy, and stress-free as can be.

Most expensive cities to own a home

By far, San Francisco is the most expensive city to live in, with an average home price per square foot of $1,070.92. The next most expensive city, Boston, Massachusetts, still costs $328.72 less per square foot than San Francisco. The majority of the most expensive cities cost between $500 to $680 or more per square foot.

Pricing according to August 2019 Zillow data.

It costs nearly twice as much to live in San Francisco as it does to live in Oakland, which is less than twenty minutes away. As experts have pointed out, many people move from one large city to another rather than merely fleeing from cities altogether.8

Ready to move?

Data as of post date. Offers and availability may vary by location and are subject to change. Pricing data collected by requesting estimates from top moving container companies for four home sizes across six distances.

*There are 10 states where Colonial can't pick up your belongings, and four where they can't deliver. Call Colonial to confirm availability.

Most expensive cities for 1-bedroom rent per square foot

Renting and buying may differ, and Oakland is a good example of that. Oakland is the tenth most expensive place to own, but the second most expensive place to rent.

Pricing according to August 2019 Zillow data.

Sunnyvale, California (#4) and Jersey City, New Jersey (#7) made the top ten list for expensive rent, but not for ownership. Whereas Honolulu, Hawaii and Glendale, California made the top ten list for expensive ownership, but renters may have better luck.

What are the differences between buying and renting?

Buying gives you a final price that you’re chipping away at, and each payment you make builds your equity. Buying usually means a higher upfront cost, a commitment to a loan, and paying for your maintenance, repairs, property taxes, and more.

Renting involves less additional costs outside your lease and gives you more flexibility for leaving, but it does not allow you to build value over time.

For example, San Jose, California, ranked as number six for renting and buying, so let’s see how those two options compare.

- San Jose, CA rent per square foot: $3.69

- San Jose, CA home price per square foot: $625.86

You could buy a 1,000-square-foot home in San Jose for $625,000. Over a 30-year loan, that’s roughly $20,862 per year or $1,738 per month. These prices don’t include additional costs like taxes, interest, or repairs, but it gives you a starting point to see where your money is going every month.

Renting a one-bedroom apartment costs $3,690 per month or $44,280 per year. Imagine renting in the same area over 30 years and paying $1,328,400. That assumes rent doesn’t go up either, which it usually does.

Unfortunately, renting is the only option for more than 70% of the country who can’t afford a home, regardless of whether it’s in an expensive city or not.9

Will America’s most expensive cities become more affordable?

Housing is a complicated situation, but knowing the cost of where you want to live may help narrow down your choices. There are a few ways of reducing your costs when you’re in a big city, like getting roommates, picking up more work, or getting a smaller place and keeping non-essentials in storage.

If nothing else, this list may help you appreciate your hometown’s cost of living a little more. The market’s future remains uncertain and perhaps irreversibly changed after the impact of COVID-19,10 but hopefully, we’ll see a shift to make housing affordable for more Americans.

What is the most expensive city in the US?

San Francisco is the most expensive city in the US, with an average home cost of $1,070.92 per square foot.

Methodology

Using Zillow’s housing data, we looked at the cost per square foot for both owning a home and one-bedroom rentals in the top 200 most populous cities.

We used the median list price for homes in each city for ownership and median rent for one-bedroom apartments for rental prices.

Sources

- Center for Sustainable Systems, University of Michigan. “US Cities Factsheet,” 2020. Accessed October 12, 2020.

- Katherine Schaeffer, Pew Research Center, “6 Facts about Economic Inequality in the US,” February 7, 2020. Accessed October 16, 2020.

- Kim Parker, Rachel Minkin, Jesse Bennett, Pew Research Center, “Economic Fallout From COVID-19 Continues To Hit Lower-Income Americans the Hardest,” September 24, 2020. Accessed October 12, 2020.

- Public Policy Institute of California, “Income Inequality in California,” January 2020. Accessed October 16, 2020.

- Legislative Analyst’s Office, California Legislature, California’s High Housing Costs: Causes and Consequences,” March 17, 2015.

- Sarah Bohn, Caroline Danielson, Tess Thorman, PPIC.org, “Poverty in California” July 2020.

- Zillow, “Housing Data,” August 2019. Accessed October 12, 2020.

- Marie Patino, Bloomberg CityLab, “What We Actually Know About How Americans Are Moving During Covid” September 16, 2020.

- Attom, “Median-Priced Homes Not Affordable for Average Wage Earners in 71 Percent of US Housing Markets” March 26, 2019.

- Peter Lane Taylor, Forbes, “COVID-19 Has Changed The Housing Market Forever. Here’s Where Americans Are Moving (And Why),” October 11, 2020.