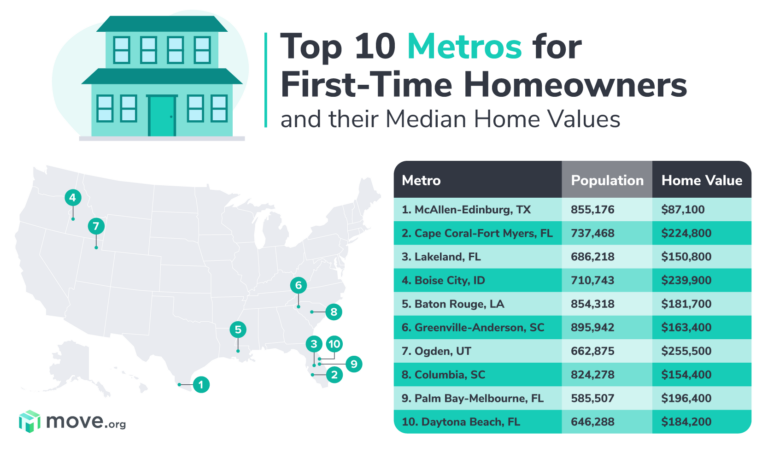

Rank | City | Median Home Value | Population | Percentage of homes built in or since 2000 | Percentage of occupied homes |

1

| McAllen-Edinburg-Mission, TX Metro Area

| $87,100

| 855,176

| 40%

| 68%

|

|---|

2

| Cape Coral-Fort Myers, FL Metro Area

| $224,800

| 737,468

| 37%

| 72.3%

|

|---|

3

| Lakeland-Winter Haven, FL Metro Area

| $150,800

| 686,218

| 30%

| 68.9%

|

|---|

4

| Boise City, ID Metro Area

| $239,900

| 710,743

| 35%

| 69.7%

|

|---|

5

| Baton Rouge, LA Metro Area

| $181,700

| 854,318

| 29%

| 69%

|

|---|

6

| Greenville-Anderson, SC Metro Area

| $163,400

| 895,942

| 25%

| 68.5%

|

|---|

7

| Ogden-Clearfield, UT Metro Area

| $255,500

| 662,875

| 29%

| 75.8%

|

|---|

8

| Columbia, SC Metro Area

| $154,400

| 824,278

| 28%

| 67.9%

|

|---|

9

| Palm Bay-Melbourne-Titusville, FL Metro Area

| $196,400

| 585,507

| 22%

| 74.3%

|

|---|

10

| Deltona-Daytona Beach-Ormond Beach, FL Metro Area

| $184,200

| 646,288

| 25%

| 71.2%

|

|---|

11

| Augusta-Richmond County, GA-SC Metro Area

| $146,100

| 599,616

| 25%

| 67.1%

|

|---|

12

| Des Moines-West Des Moines, IA Metro Area

| $182,400

| 680,439

| 27%

| 69.7%

|

|---|

13

| North Port-Sarasota-Bradenton, FL Metro Area

| $246,400

| 803,709

| 27%

| 74%

|

|---|

14

| Charlotte-Concord-Gastonia, NC-SC Metro Area

| $200,000

| 2,545,560

| 33%

| 65.7%

|

|---|

15

| Little Rock-North Little Rock-Conway, AR Metro Area

| $154,600

| 737,015

| 28%

| 64.1%

|

|---|

16

| Knoxville, TN Metro Area

| $171,300

| 853,337

| 22%

| 68.7%

|

|---|

17

| Raleigh-Cary, NC Metro Area

| $249,800

| 1,332,311

| 39%

| 65.7%

|

|---|

18

| El Paso, TX Metro Area

| $121,300

| 840,477

| 28%

| 61.2%

|

|---|

19

| Jackson, MS Metro Area

| $145,600

| 597,727

| 22%

| 67.3%

|

|---|

20

| Birmingham-Hoover, AL Metro Area

| $165,200

| 1,085,330

| 22%

| 68.9%

|

|---|

21

| Grand Rapids-Kentwood, MI Metro Area

| $172,900

| 1,062,392

| 17%

| 72.8%

|

|---|

22

| Provo-Orem, UT Metro Area

| $303,300

| 616,791

| 40%

| 67.9%

|

|---|

23

| Chattanooga, TN-GA Metro Area

| $163,100

| 556,209

| 21%

| 67.1%

|

|---|

24

| Winston-Salem, NC Metro Area

| $152,400

| 666,216

| 20%

| 66.8%

|

|---|

25

| San Antonio-New Braunfels, TX Metro Area

| $171,000

| 2,468,193

| 32%

| 62.6%

|

|---|

26

| Charleston-North Charleston, SC Metro Area

| $236,700

| 774,508

| 33%

| 66.2%

|

|---|

27

| Jacksonville, FL Metro Area

| $204,700

| 1,503,574

| 31%

| 64.5%

|

|---|

28

| Oklahoma City, OK Metro Area

| $157,600

| 1,382,841

| 24%

| 63.8%

|

|---|

29

| Tulsa, OK Metro Area

| $150,500

| 990,544

| 21%

| 64.8%

|

|---|

30

| Nashville-Davidson--Murfreesboro--Franklin, TN Metro Area

| $240,800

| 1,871,903

| 30%

| 65.6%

|

|---|

31

| Albuquerque, NM Metro Area

| $192,800

| 912,108

| 22%

| 67%

|

|---|

32

| Indianapolis-Carmel-Anderson, IN Metro Area

| $163,100

| 2,029,472

| 22%

| 65.2%

|

|---|

33

| Greensboro-High Point, NC Metro Area

| $149,200

| 762,063

| 21%

| 62.6%

|

|---|

34

| Houston-The Woodlands-Sugar Land, TX Metro Area

| $193,900

| 6,884,138

| 34%

| 60.4%

|

|---|

35

| Louisville/Jefferson County, KY-IN Metro Area

| $169,500

| 1,257,088

| 18%

| 67.1%

|

|---|

36

| Wichita, KS Metro Area

| $139,000

| 637,690

| 17%

| 65%

|

|---|

37

| Tucson, AZ Metro Area

| $184,100

| 1,027,207

| 23%

| 63.2%

|

|---|

38

| Phoenix-Mesa-Chandler, AZ Metro Area

| $250,000

| 4,761,603

| 32%

| 63.4%

|

|---|

39

| Atlanta-Sandy Springs-Alpharetta, GA Metro Area

| $217,000

| 5,862,424

| 31%

| 63.3%

|

|---|

40

| St. Louis, MO-IL Metro Area

| $172,700

| 2,805,190

| 15%

| 68.9%

|

|---|

41

| Omaha-Council Bluffs, NE-IA Metro Area

| $171,000

| 931,779

| 21%

| 65.5%

|

|---|

42

| Pittsburgh, PA Metro Area

| $154,000

| 2,331,447

| 9%

| 69.6%

|

|---|

43

| Orlando-Kissimmee-Sanford, FL Metro Area

| $221,600

| 2,508,970

| 33%

| 60.9%

|

|---|

44

| Durham-Chapel Hill, NC Metro Area

| $226,100

| 626,695

| 29%

| 61.7%

|

|---|

45

| Cincinnati, OH-KY-IN Metro Area

| $168,900

| 2,201,741

| 16%

| 66.4%

|

|---|

46

| Tampa-St. Petersburg-Clearwater, FL Metro Area

| $193,500

| 3,097,859

| 22%

| 64.9%

|

|---|

47

| Harrisburg-Carlisle, PA Metro Area

| $183,400

| 571,013

| 15%

| 67.6%

|

|---|

48

| Akron, OH Metro Area

| $150,000

| 703,845

| 12%

| 66.6%

|

|---|

49

| Kansas City, MO-KS Metro Area

| $183,300

| 2,124,518

| 19%

| 65.1%

|

|---|

50

| Scranton--Wilkes-Barre, PA Metro Area

| $139,400

| 555,642

| 8%

| 67%

|

|---|

51

| Austin-Round Rock-Georgetown, TX Metro Area

| $281,500

| 2,114,441

| 42%

| 58.2%

|

|---|

52

| Syracuse, NY Metro Area

| $137,200

| 652,416

| 9%

| 67.6%

|

|---|

53

| Detroit-Warren-Dearborn, MI Metro Area

| $170,000

| 4,317,848

| 11%

| 69%

|

|---|

54

| Toledo, OH Metro Area

| $130,900

| 644,137

| 11%

| 63.3%

|

|---|

55

| Memphis, TN-MS-AR Metro Area

| $152,200

| 1,339,623

| 20%

| 59.8%

|

|---|

56

| Dallas-Fort Worth-Arlington, TX Metro Area

| $215,700

| 7,320,663

| 30%

| 59.5%

|

|---|

57

| Rochester, NY Metro Area

| $144,400

| 1,072,877

| 10%

| 67.1%

|

|---|

58

| Columbus, OH Metro Area

| $184,800

| 2,077,761

| 20%

| 61.5%

|

|---|

59

| Minneapolis-St. Paul-Bloomington, MN-WI Metro Area

| $257,000

| 3,573,609

| 19%

| 70%

|

|---|

60

| Dayton-Kettering, OH Metro Area

| $135,000

| 803,543

| 10%

| 63.2%

|

|---|

61

| Salt Lake City, UT Metro Area

| $298,600

| 1,201,043

| 24%

| 67.8%

|

|---|

62

| Cleveland-Elyria, OH Metro Area

| $151,600

| 2,056,898

| 9%

| 64.9%

|

|---|

63

| Richmond, VA Metro Area

| $237,500

| 1,269,530

| 21%

| 65.6%

|

|---|

64

| Buffalo-Cheektowaga, NY Metro Area

| $148,500

| 1,130,175

| 7%

| 65.7%

|

|---|

65

| Las Vegas-Henderson-Paradise, NV Metro Area

| $262,700

| 2,182,004

| 37%

| 53.8%

|

|---|

66

| Colorado Springs, CO Metro Area

| $275,700

| 723,498

| 26%

| 64.7%

|

|---|

67

| Allentown-Bethlehem-Easton, PA-NJ Metro Area

| $213,800

| 837,610

| 15%

| 68.8%

|

|---|

68

| New Orleans-Metairie, LA Metro Area

| $197,800

| 1,267,777

| 16%

| 62.3%

|

|---|

69

| Bakersfield, CA Metro Area

| $213,900

| 887,641

| 22%

| 58.3%

|

|---|

70

| Madison, WI Metro Area

| $248,400

| 653,725

| 23%

| 61.1%

|

|---|

71

| Albany-Schenectady-Troy, NY Metro Area

| $213,600

| 880,736

| 13%

| 63.9%

|

|---|

72

| Virginia Beach-Norfolk-Newport News, VA-NC Metro Area

| $245,100

| 1,761,729

| 19%

| 61.7%

|

|---|

73

| Chicago-Naperville-Elgin, IL-IN-WI Metro Area

| $239,600

| 9,508,605

| 14%

| 64.5%

|

|---|

74

| Philadelphia-Camden-Wilmington, PA-NJ-DE-MD Metro Area

| $250,700

| 6,079,130

| 11%

| 67.3%

|

|---|

75

| Milwaukee-Waukesha, WI Metro Area

| $213,900

| 1,575,223

| 11%

| 60.1%

|

|---|

76

| Riverside-San Bernardino-Ontario, CA Metro Area

| $341,300

| 4,560,470

| 25%

| 63.3%

|

|---|

77

| Worcester, MA-CT Metro Area

| $269,600

| 941,338

| 11%

| 65.6%

|

|---|

78

| Springfield, MA Metro Area

| $228,100

| 699,480

| 7%

| 63.2%

|

|---|

79

| Poughkeepsie-Newburgh-Middletown, NY Metro Area

| $276,500

| 673,839

| 14%

| 67.7%

|

|---|

80

| Baltimore-Columbia-Towson, MD Metro Area

| $298,500

| 2,796,733

| 14%

| 66.5%

|

|---|

81

| Hartford-East Hartford-Middletown, CT Metro Area

| $249,200

| 1,207,677

| 9%

| 66.3%

|

|---|

82

| Denver-Aurora-Lakewood, CO Metro Area

| $380,900

| 2,892,066

| 24%

| 63.9%

|

|---|

83

| Fresno, CA Metro Area

| $255,000

| 984,521

| 20%

| 53.3%

|

|---|

84

| Portland-Vancouver-Hillsboro, OR-WA Metro Area

| $368,800

| 2,445,761

| 21%

| 62.4%

|

|---|

85

| Miami-Fort Lauderdale-Pompano Beach, FL Metro Area

| $280,400

| 6,090,660

| 17%

| 59.3%

|

|---|

86

| Stockton, CA Metro Area

| $342,100

| 742,603

| 23%

| 56.6%

|

|---|

87

| Providence-Warwick, RI-MA Metro Area

| $276,900

| 1,618,268

| 8%

| 61.4%

|

|---|

88

| New Haven-Milford, CT Metro Area

| $248,600

| 857,513

| 7%

| 61.8%

|

|---|

89

| Sacramento-Roseville-Folsom, CA Metro Area

| $387,500

| 2,315,980

| 21%

| 60.3%

|

|---|

90

| Seattle-Tacoma-Bellevue, WA Metro Area

| $436,100

| 3,871,323

| 23%

| 60.1%

|

|---|

91

| Washington-Arlington-Alexandria, DC-VA-MD-WV Metro Area

| $424,000

| 6,196,585

| 21%

| 63.6%

|

|---|

92

| Bridgeport-Stamford-Norwalk, CT Metro Area

| $428,500

| 943,926

| 11%

| 67.1%

|

|---|

93

| Boston-Cambridge-Newton, MA-NH Metro Area

| $437,500

| 4,832,346

| 12%

| 61.7%

|

|---|

94

| Oxnard-Thousand Oaks-Ventura, CA Metro Area

| $588,400

| 847,263

| 13%

| 63.2%

|

|---|

95

| New York-Newark-Jersey City, NY-NJ-PA Metro Area

| $450,900

| 19,294,236

| 10%

| 51.3%

|

|---|

96

| San Diego-Chula Vista-Carlsbad, CA Metro Area

| $563,700

| 3,316,073

| 16%

| 53.3%

|

|---|

97

| Urban Honolulu, HI Metro Area

| $678,200

| 984,821

| 15%

| 56.2%

|

|---|

98

| Los Angeles-Long Beach-Anaheim, CA Metro Area

| $613,400

| 13,249,614

| 9%

| 48.6%

|

|---|

99

| San Francisco-Oakland-Berkeley, CA Metro Area

| $840,600

| 4,701,332

| 11%

| 54.7%

|

|---|

100

| San Jose-Sunnyvale-Santa Clara, CA Metro Area

| $968,800

| 1,987,846

| 15%

| 56.6%

|

|---|